Last week, Florida Power & Light, subsidiary of NextEra Energy, submitted their annual filings on the need for two more nuclear units at its Turkey Point station. The units are projected to come online in 2022 and 2023. Below are a few highlights from one of the filings (pdf), p. 4:

assuming the same medium fuel cost, “Environmental II” scenario, FPL expects that Turkey Point 6 & 7 will:

- Provide estimated fuel cost savings for FPL’s customers of approximately $1.07 billion (nominal) in the first full year of operation;

- Provide estimated fuel cost savings for FPL’s customers over the life of the project of approximately $75 billion (nominal);

- Diversify FPL’s fuel sources by decreasing reliance on natural gas by approximately 13% beginning in the first full year of operation;

- Reduce annual fossil fuel usage by the equivalent of 28 million barrels of oil or 177 million mmBTU of natural gas; and

- Reduce C02 emissions by an estimated 287 million tons over the life of the project, which is the equivalent of operating FPL’s entire generating system with zero CO2 emissions for 7 years.

And on page 11:

As described by Dr. Sim, Turkey Point 6 & 7 also continues to be a cost-effective addition for FPL’s customers, taking into account all updated assumptions. FPL’s analysis of Turkey Point 6 & 7 was performed by calculating a “breakeven capital cost” - the capital cost amount FPL could spend on new nuclear and breakeven with what it would spend for a combined cycle resource addition on a CPVRR [cumulative present value of revenue requirements] basis - and comparing it to its current project non-binding cost estimate range. The breakeven costs are higher than FPL’s cost estimate (i.e., the results are favorable) in six out of seven fuel and environmental compliance cost scenarios analyzed, and in the seventh, the breakeven costs are within the non-binding cost estimate range.

Accordingly, Turkey Point 6 & 7 continues to be an economically sound choice for FPL’s customers. Additionally, as explained by Mr. Scroggs, the Turkey Point 6 & 7 project remains feasible with respect to other, non-economic considerations.

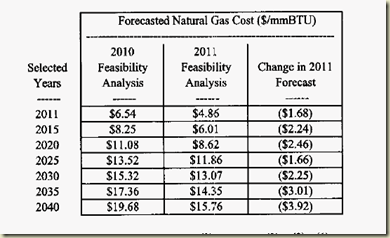

For their detailed analysis, see FPL’s testimony from Steven Sim (pdf). In it, you can find their updated capital cost assumptions which are $3,483/kW to $5,063/kW in 2011 dollars (page 49 of 107). As well, pasted below are their assumed costs for natural gas in nominal dollars (page 41 of 107).

The capital costs for a new nuclear unit and the fuel price of natural gas are two key factors in determining the competitiveness of nuclear. Even with a huge glut of gas in the country, new nuclear is still found to be economical.

Comments