Witness testimony from more than 120 former or retired military personnel points to an ongoing and alarming intervention by unidentified aerial objects at nuclear weapons sites, as recently as 2003. In some cases, several nuclear missiles simultaneously and inexplicably malfunctioned while a disc-shaped object silently hovered nearby.

It gets better:

Declassified U.S. government documents, to be distributed at the [upcoming Press Club] event, now substantiate the reality of UFO activity at nuclear weapons sites extending back to 1948. The press conference will also address present-day concerns about the abuse of government secrecy as well as the ongoing threat of nuclear weapons.

I might just go to the Press Club event mentioned in the article.

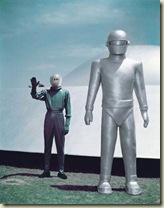

That’s Klaatu (good cop) on the left, Gort (bad cop) on the right, from the Day the Earth Stood Still (1951). Remember, if you ever find yourself facing Gort in a dark alley, the words Klaatu Berada Nikto will save your bacon.

Comments

Another source of information on UFOs and the military is the Leslie Kean book that appeared this year. However, I must say that these kinds of books always turn out to be rather frustrating—they relate dramatic and compelling stories, but stories that are hard for the reader to verify (e.g., the author relies on sources that refuse to go public), and skeptics often find holes and inconsistencies or other problems with the stories. The Kean book is no exception.