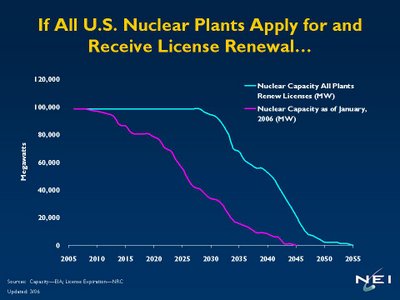

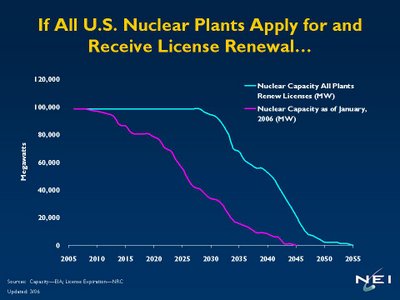

To date, 39 nuclear reactors have received 20 year license extensions. 12 other reactors have filed for an extension and another 27 which have announced intentions to do so. If all 103 nuclear reactors in the U.S. receive a 20 year extension, and the industry anticipates they will, the first retirement will not be until 2029.

When a nuclear plant retires, the primary source of fuel for its replacement would be coal. A typical 1,000 MW nuclear plant consumes about 20 metric tons of uranium during its fuel cycle (18 or 24 months). A comparable coal plant would need about 3.43 million tons of coal each year to provide the same generation as a nuclear plant. And as we saw earlier this week, transporting large volumes of coal can present other challenges as well.

When a nuclear plant retires, the primary source of fuel for its replacement would be coal. A typical 1,000 MW nuclear plant consumes about 20 metric tons of uranium during its fuel cycle (18 or 24 months). A comparable coal plant would need about 3.43 million tons of coal each year to provide the same generation as a nuclear plant. And as we saw earlier this week, transporting large volumes of coal can present other challenges as well.

To replace the same generation with a natural gas plant, you'd need 65.8 billion cubic feet of gas, and for oil, 13.7 million barrels.

If you multiply these figures by 20 years you would need:

And then there's the question of carbon emissions. The average coal plant emits 2,217 pounds of CO2 per megawatt hour. The average oil plant emits 1,819 lbs / MWh and the average natural gas plant emits 1,115 lbs / MWh. The average nuclear reactor generates 7.9 million MWh each year. If a nuke plant were replaced by coal, there would be an additional 7.928 million metric tons of CO2 in the air each year. An oil plant would emit 6.5 million metric tons of CO2 and a natural gas plant would emit 4.0 million metric tons of CO2.

This is only one year and for one unit. I'll let you do the math for the additional twenty years and 103 nuclear reactors.

So the question is this: Would you rather have an additional 41,000 metric tons of used uranium fuel stored safely and securely in dry casks or more than 8,000,000,000 metric tons of CO2 injected into the atmosphere? The next time somebody asks you about the nuclear waste problem, be sure to mention those 8,000,000,000 additional metric tons of CO2.

Technorati tags: Nuclear Energy, Environment, Energy, Technology, Electricity, Natural Gas, Oil, Uranium, Climate Change, Greenhouse Gases

When a nuclear plant retires, the primary source of fuel for its replacement would be coal. A typical 1,000 MW nuclear plant consumes about 20 metric tons of uranium during its fuel cycle (18 or 24 months). A comparable coal plant would need about 3.43 million tons of coal each year to provide the same generation as a nuclear plant. And as we saw earlier this week, transporting large volumes of coal can present other challenges as well.

When a nuclear plant retires, the primary source of fuel for its replacement would be coal. A typical 1,000 MW nuclear plant consumes about 20 metric tons of uranium during its fuel cycle (18 or 24 months). A comparable coal plant would need about 3.43 million tons of coal each year to provide the same generation as a nuclear plant. And as we saw earlier this week, transporting large volumes of coal can present other challenges as well.To replace the same generation with a natural gas plant, you'd need 65.8 billion cubic feet of gas, and for oil, 13.7 million barrels.

If you multiply these figures by 20 years you would need:

68.6 million tons of coal; orThis is for one plant. If a nuclear reactor does not renew its license for another twenty years, the U.S. would need that much more coal or natural gas or oil to meet the same demand. Take these figures and multiply by the 103 nuclear units in the U.S. and you get:

1,316 billion cubic feet of gas; or

274 million barrels of oil

7,065 million tons of coal;The amount of uranium for the additional 20 years needed for the entire nuclear fleet would only be about 41,000 metric tons.

135,548 billion cubic feet of gas;

28,222 million barrels of oil.

And then there's the question of carbon emissions. The average coal plant emits 2,217 pounds of CO2 per megawatt hour. The average oil plant emits 1,819 lbs / MWh and the average natural gas plant emits 1,115 lbs / MWh. The average nuclear reactor generates 7.9 million MWh each year. If a nuke plant were replaced by coal, there would be an additional 7.928 million metric tons of CO2 in the air each year. An oil plant would emit 6.5 million metric tons of CO2 and a natural gas plant would emit 4.0 million metric tons of CO2.

This is only one year and for one unit. I'll let you do the math for the additional twenty years and 103 nuclear reactors.

So the question is this: Would you rather have an additional 41,000 metric tons of used uranium fuel stored safely and securely in dry casks or more than 8,000,000,000 metric tons of CO2 injected into the atmosphere? The next time somebody asks you about the nuclear waste problem, be sure to mention those 8,000,000,000 additional metric tons of CO2.

Technorati tags: Nuclear Energy, Environment, Energy, Technology, Electricity, Natural Gas, Oil, Uranium, Climate Change, Greenhouse Gases

Comments

Or in other words, one truckload per year for nuclear, versus 30,000 railcars per year for coal.

You are correct. See:

Coal Cumbustion: Nuclear Resource or Danger

< http://www.ornl.gov/info/ornlreview/rev26-34/text/colmain.html >

Radioactive Elements in Coal and Fly Ash:

Abundance, Forms, and Environmental Significance

< http://greenwood.cr.usgs.gov/energy/factshts/163-97/FS-163-97.html >

Radioactivity in Coal and Flyash

< http://www.we-energies.com/environmental/ccp_handbook_appendixb.pdf >

About license renewal...

Did you all catch that we got the first extension hearing on a technical contention before the Atomic Safety Licensing Board on the issue of severe corrosion of the Mark I containment at Oyster Creek?

Now, NRC staff is looking at requiring age degraded review for all Mark I containment corrosion.

You guys have the public meeting on the with staff but I imagine the queue for the bridgeline is already jammin' up.

Its going to start gettiing interesting when we start shining bright lights (the UT kind) down in the basement at the basemat where the drywell liner submerges into the concrete. You know its gotta be ugly for the largest steel component in the oldest operating nuke in the fleet.

Any of you folks been down in a bwr sandbed?

gunter

Congrats. It's important that Oyster Creek is thoroughly evaluated before it receives a license renewal. As well as any other nuke plant.

Unfortunately, it is not getting enough of the scrutiny that is needed due to biased nature of current oversight and licensing.

In the matter of Oyster Creek, the State of New Jersey Department of Environmental Protection's Bureau of Nuclear Engineering had also put in a contention on the elevated nuclear waste storage pond that sits atop the Mark I reactor building.

We noticed because this issue has been at the top of our agenda for several years and even a subject of frequent dicussion on this blog.

Specifically, the state's contention focuses on the lack of a Severe Accident Mitigation Analysis for an aircraft crash or attack on the GE Mark I BWR elevated fuel pool.

NRC denied NJ a hearing on this contention and two other issues.

If Oyster Creek was to truly get a thorough evaluation, we would be looking at the vulnerability of the spent fuel pool in the context of relicensing. The National Academy of Sciences could provide the expert witness for the structural engineering analysis to show that a small private aircraft laden with explosive would be sufficient to ignite a zircaloy fuel fire. Since Nobody Really Cares (NRC) about small aircraft to even notice their flight paths in context of Emergency Action Levels or provide any kind of impediments to aircraft delivered explosives. Just more evidence of this hog tied regulator.

I frankly take no comfort in relying on a lot of Chornobyl fire fighters.

But I suppose that would contention muck up the the cozy arrangement between NRC and industry's production agenda to be taken seriously.

Lets hope that the state appeals this one over the heads of the Commission.

gunter