President-elect Barack Obama has put forth a goal to reduce carbon emissions in the U.S. by 80% by 2050, using $150 billion over 10 years to create a "clean-energy" future. Nuclear plants are the biggest producers of energy that doesn't emit any greenhouse gases.

Not just biggest, but only one able to produce baseload electricity, that is, not hampered by when the wind blows or when the sun shines. Barron’s, where this came from, is chiefly interested in suggesting where their readership might invest their money – which we never recommend you follow unless you do your own research – but that impulse to sniff out the money leads to this tidbid:

Notwithstanding the increased difficulty of obtaining financing since the credit crisis erupted, Cambridge Energy Research Associates has estimated that the potential for world-wide investment in clean energy, of which nuclear generation is the focal point, will reach $7 trillion in real 2007 dollars by 2030.

We think once you reach a trillion or so, you might as well say a zillion-kajillion – money just doesn’t make much sense at this level because mere mortals have no context for it. But we the idea – a lot of clams.

Speaking of a lot of money, here is NEI’s contribution to the story, when author Robin Golden Blumenthal addresses the cost of building a nuclear plant:

Yet the Nuclear Energy Institute, the industry trade group, maintains that the capital costs become competitive due to nuclear plants' lower operating costs versus gas producers' costs. What's more, cost comparisons with other types of energy producers don't reflect any benefit that nuclear operators might see from carbon credits.

True enough, though we’d mention that loan guarantees tilt the balance even further back in the direction of fiscal sanity. We also do not know yet how cap-and-trade, where those carbon credits will come from, will work. The last stab at cap-and-trade went down fairly hard in the Senate less than a year ago, though it doubtless will return in some form.

The story is worth a read, especially as it addresses an issue that will come into focus as the Obama administration’s ambitions run into reality: that any effective plan for carbon reduction requires nuclear energy. Without it, those ambitions cannot be achieved.

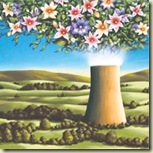

Scott Pollack’s picture that accompanies the Barron’s article. We like it lots.

Comments

Nuclear is fuel cycle limited, while carbon burners are maintenance limited. We have some control over those limits, at least as far as planning ahead and juggling available generating assets in a preplanned manner is concerned.

With natural phenomena, you have no control and you're always in a position of having to scramble, flying by the seat of your pants when you come down to it. That might be manageable on an individual level, but running an advanced, technologically-based society based on those unreliable and chaotic energy sources is going to be a dicey proposition at best.

I like the blog, and continue in the debate. Nuclear may be part of the answer, with better safety records and with an answer to the waste issue.

Also see my link to the article

http://sri-extra.blogspot.com/2009/01/russians-are-coming-strutting-nuclear.html

Regards

GS

Principal | Sinclair & Company | http://sinclairconsult.com | graham.sinclair@sinclairconsult.com

Commentator | SRI Extra | http://sri-extra.blogspot.com

Adjunct Professor | Kenan-Flagler Business School UNC-Chapel Hill | http://kenan-flagler.unc.edu | graham_sinclair@unc.edu