Having received White House backing, the Environmental Protection Agency declared Friday that carbon dioxide and other greenhouse gases are a significant threat to human health and thus will be listed as pollutants under the Clean Air Act — a policy the Bush administration rejected.

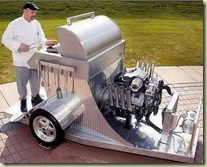

You’ll remember that this became a point in the last election, with fears of backyard barbecues being shut down. But the intent is more likely this:

The move could allow the EPA to regulate greenhouse gases, but it's more likely that the Obama administration will use the action to prod Congress to pass regulations around a system to cap and then trade emissions so that they are gradually lowered.

As you might expect, the usual suspects have lined up. One one side:

The EPA should be required "to follow up with standards under the Clean Air Act, the nation's most effective environmental law, to curb carbon pollution from our cars, power plants and other industrial sources," said David Doniger, climate policy director at the Natural Resources Defense Council.

And on the other:

"It will require a huge cascade of (new clean air) permits" and halt a wide array of projects, from building coal plants to highway construction, including many at the heart of economic recovery plan,” Bill Kovacs, a vice president for environmental issues at the [Chamber of commerce], said when the EPA's recommendations were made last month.

We suspect EPA Director Lisa Jackson has at the least put Congress on alert that fussing too much about cap-and-trade may not be too wise, since EPA regulation can cover a lot of territory – in other words, a little political gameplaying.

When you have a yen for kabob – or a quick trip to Canada.

Comments

Also, what happens to regulation of green house gas emissions from automobiles, trucks, trains, aircraft, ships and almost all other modes of transport? Will a green house tax be put on gasoline and diesel fuel and jet fuel, making (for instance) gasoline prices rise above the $4.00 / gallon we experienced in 2008? Who can afford that with the economy tanking, businesses folding and people losing their jobs?

Oh, maybe I am just a pessimist, but this doesn't look economically like a good time to start regulating green house gases. Can anybody out there see a light at the end of the tunnel that isn't an on-coming train?

Utilities could then be fined with carbon taxes if they failed to meet these percentages. And a carbon sin tax could also be placed on transportation fuel (gasoline, methanol, diesel fuel, jet fuel) sold in America if they also did not contain a certain Federally mandated percentage of carbon neutral fuel.

We've known how to build power plants that don't produce carbon dioxide for decades. And we've also known how to produce carbon-neutral synthetic fuels (gasoline, methanol, diesel fuel, jet fuel) for decades.

We're not going to go from a fossil fuel economy to a non-fossil fuel economy overnight. Its going to take a few decades. But we're never going to get there if we don't get started in that direction-- right now!

http://newpapyrusmagazine.blogspot.com/

This is a bit silly. The average metabolic rate for humans is about 100 watts. In the U.S., enjoying the lifestyles we lead, we use about 30 times this much energy (thus so little manual labor anymore).

Carbon controls are all about cutting back on our use of coal. In the U.S. we mine and burn 1.2 billion tons per year, which works out to 4 tons for every person in the U.S. Carbon controls are about cutting back the size of this coal pile, not about controlling people's weight.

France was 45% coal-fired electricity in 1975, but closed its last coal power plant in 2004. The technology we need to cut coal use and carbon emissions is obvious.