Australia has decided to put a price on carbon in the hope that it can kick-start its renewable energy i

The Australian government has unveiled plans to impose a tax on carbon emissions for the worst polluters.

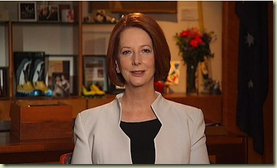

Prime Minister Julia Gillard said carbon dioxide emissions would be taxed at A$23 ($25) per ton from 2012.

The country's biggest economic reform in a generation will cover some 500 companies. In 2015, a market-based trading scheme will be introduced.

Households are expected to see consumer prices rise by nearly 1%, and the move has been criticised by the opposition.

The announcement by Gillard has led to a healthy debate about the plan, to put it mildly, as you can see on the comment section of this article. The greater question is: Will this lead to Australia to reconsider nuclear power?

"No one will build coal-fired power plants," he [Paul Breslin]said. "It is already sending a signal to prospective investors 'don't do it'. You couldn't possibly build a new coal-fired power station at $20 per ton, and the price is definitely going to rise.

"If the carbon price keeps going up in the 2030s, we will need to be moving to gas-fired electricity generation. Safe nuclear, although politically difficult, should be looked at."

Nuclear energy would seem a natural fit for Australia. It has high per capita emissions, abundant uranium resources and seems especially sensitive to the nastier consequences of climate change in Australia itself. But then again, the country has never really shown any great enthusiasm for embracing nuclear. Even the prime minister has distanced herself from the technology. And there’s the question of whether and how the whole carbon pricing plan will come to fruition.

But with the need to keep the lights on (and the air conditioners humming) and with a potentially rising price on carbon, nuclear energy will surely become more attractive over time. Stay tuned.

For more on the carbon price plan, see this website from the Australian government.

Comments

This kind of legislative bias even if it it doesn't actually happen in Australia is unfortunately enough of a risk to significantly reduce the future assessment of earnings for a proposed nuclear project. Nuclear power really needs a long-term assurance that it will not be targeted by the government. Guaranteed power purchase schemes, like those being floated in the UK, are one way to provide some of this assurance.