In 2008, the Energy Information Administration published a report that provided a snapshot of the amount of federal incentives each energy technology received during the year 2007. Three years later, EIA released an updated analysis that looked at the federal incentives received in 2010.

Below is the summary table EIA generated by examining the energy incentives for all sectors (p. xii). Renewables by far have received more incentives in 2010 than any other beneficiary: 40 percent of the total.

If we look at the incentives received in just the electric sector (a subset of the overall energy sector), the numbers expose even more favor for renewables, which garnered 55 percent of the electric sector’s incentives in 2010 (p. xviii).

What about nuclear?

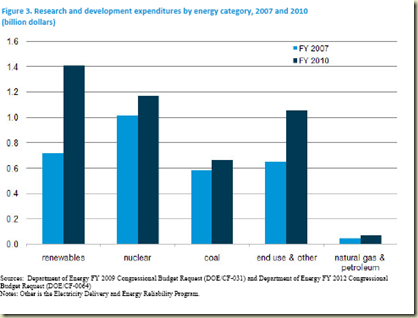

Incentives for nuclear have largely been for research and development. Since 1978, nuclear has received more R&D incentives than any other technology. Most of the R&D expenditures for nuclear took place in the 1970s and 1980s (p. 34).

Times have changed though. R&D for renewables has doubled over the last three years and surpassed nuclear in 2010 (p. 35).

Predictably, the report has not been well received by a number of the renewable fans. Basically, folks are knocking the new analysis because it only looks at one year’s worth of incentives and doesn’t quantify fully all of the incentives available for all technologies (as if that’s easy to do).

It’s interesting that the Union of Concerned Scientists, Climate Progress, Grist and others looked for reasons to dismiss the whole report, and – surprise – found some.

Although EIA only quantifies a few years’ worth of data, the report clearly shows renewables have been receiving the lions’ share for a number of years.

It’s funny, the critics demand incentives for renewables to level the playing field. But when the data show that renewables have been receiving a good portion of incentives for a while now, the critics ignore it so they can spin the data to hammer other technologies. Which is it? Are incentives good or bad? Or is it that they’re good for renewables and bad for nuclear? Can’t have your cake and eat it too, guys.

For a study that calculates all of the incentives for all technologies back to 1950, check out this 2008 report written by the Management Information Services, Inc (pdf). The table pasted below sums up the results quite efficiently.

Comments

Can you do the same study with the other side of the coin - taxes paid?

“The Modification to Special Rules for Nuclear Decommissioning Costs Section 1310 of EPAct2005 changed the IRS rules for qualified nuclear decommissioning trust funds by repealing the cost of service requirement for contributions to a qualified decommissioning trust fund created under IRC Section 468A.”

How is that a subsidy?

We all love R&D, right? So what is the biggest line item for nuclear at $393 million for:

“Non-defense environmental cleanup”

What is that? I can explain the $213 line item for 'Generation IV Nuclear Energy Systems' $393 million sounds like a slush fund but not for nuclear.