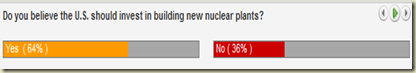

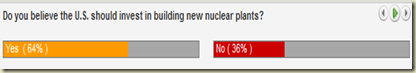

Yesterday afternoon Miles O’Brien, correspondent for Tuesday night’s FRONTLINE piece “Nuclear Aftershocks,” and producer Jon Palfreman held a live chat with the public on reactions to the documentary and overall opinions as to what the future holds for nuclear energy in the United States. What did the public decide? Well, according to an unscientific poll taken from the audience during the chat—keep building more nuclear plants!

Their opinions closely mirrored our October 2011 public opinion poll which found that 62 percent of respondents said they favor the use of nuclear energy as one of the ways to provide electricity in the United States.

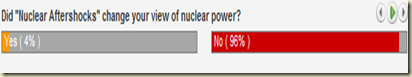

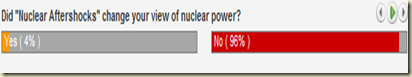

The chat’s audience also said that their opinions about nuclear power were not influenced by Tuesday night’s documentary:

This survey result really only proves one thing—that people are generally distrustful of media reports, but interested enough in the subject matter to take part in an online chat at 1 o’clock on a Wednesday afternoon!

During the chat, people posed questions on a variety of topics, including: building advanced reactors, how other countries (namely Japan and Germany) plan to meet their electricity demands and carbon reduction goals while reducing the number of nuclear plants, and how nuclear energy facilities prepare for emergencies. I took part in the one-and-a-half hour chat and provided several comments to help build on the discussion and add facts to the debate, but none of my comments were accepted or posted by the chat’s moderator. Although I am not surprised that my comments were not accepted (since I had “NEI” next to my name), I am hopeful that they will at least provide the reporters with more context to the bigger picture.

Below are a few areas where I think the discussion should have warranted a little more explanation/clarification.

1) The “Moribund” Nuclear Industry & Aging Nukes

There are two problems with this statement. First, I think it is unfair to call the industry “moribund” when there are currently 12 combined license applications that are under active review by the Nuclear Regulatory Commission to build 20 nuclear plants and new designs have either been approved (Westinghouse Electric Co.’s AP1000) or are still in the design stages in this country. Companies spend several years either designing new reactors or working to build reactors at a given site, so to equate the industry with “dying” or “inactivity” is simply untrue.

Second, and this is a point that we keep coming back to on the blog and on our website, it is important to understand that 40-year licenses for nuclear plants were never meant to be an indicator of a plant’s safe operation. The 40-year time period was simply chosen to parallel the financing amortization period for a plant. The NRC’s website explains:

2) Germany’s Nuclear Energy Situation

The nation’s nuclear power plants are among the safest and most secure industrial facilities in the United States. See for yourself. But, if you do not agree with that statement, I still think it’s important to look at the facts before making a rash decision.

Just yesterday, Siemens, which built all of Germany’s 17 nuclear plants, estimated that an exit from nuclear energy could cost the European country’s energy consumers or taxpayers as much as 1.7 trillion euros ($2.15 trillion) by 2030. Much of that estimate assumes a strong expansion of renewables, with feed-in tariffs being the biggest chunk of costs, a Reuters article reports.

Besides the high costs, cutting nuclear energy from the country’s energy portfolio will mean more carbon emissions. One of our recent blog posts quotes Laszlo Varro, the head of the gas, coal, and power markets division at the International Energy Agency, who estimates that a nuclear-free Germany could cause a 25-million-ton annual increase in CO2 emissions, mainly because of the large shift to coal power that would be needed to cover the shortfall. We also referenced a Breakthrough Institute report on our blog that predicts that Germany’s carbon emissions could rise by as much as 14 percent of the country’s 2008 total carbon emissions. These estimates do not bode well for a country that aims to reduce global greenhouse gas emissions. (They also do not bode well for O’Brien’s argument because later in the chat he says that “anything is better than coal.”)

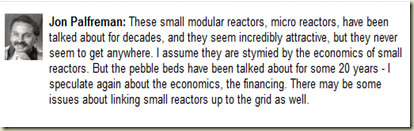

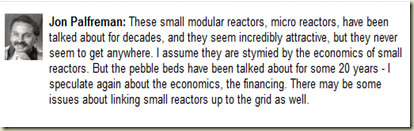

3) Small Reactors

According to some government officials and vendors I’ve talked to recently, small reactors are—the next “big” thing. Peter Lyons, the U.S. Department of Energy’s assistant secretary of nuclear energy, just yesterday said that research will be moving forward this year toward further development and design certification of small nuclear reactors. The Tri-City Herald reports:

4) Energy Conservation

Although I don’t have any immediate statistics at my disposal, I can assure you that conservation efforts will never be enough to meet growing electricity demand. The U.S. Energy Information Administration currently forecasts that electricity demand is growing at a rate of about 1 percent per year and that the United States will need 24 percent more electricity by 2035. To meet that demand, the electric utility industry must invest between $1.5 trillion and $2 trillion in new power plants, environmental controls, and transmission and distribution lines.

I do not think that unplugging our electronic devices, kitchen appliances, etc., will be enough to make up the difference in electricity supply. (I also personally don’t think the image of people wearing sandals and tee-shirts and using fans instead of A/C—like O’Brien describes that they are currently doing in Japan without the added electricity from their nuclear plants—will ever be a possibility in American culture.) However, I do think that we are on the cusp of a revolution where utilities are developing smarter ways for people to use electricity to reduce cost and alleviate daily demand through smart meters. Some are doing it very well (see a recent report by the Massachusetts Institute of Technology for examples).

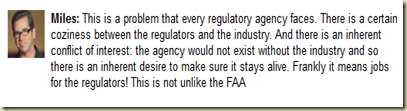

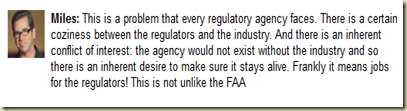

5) Relationship Between NRC & Nuclear Industry

I think this comment distorts the important work that the NRC performs each day. It is an independent agency that strives for transparency. Its five commissioners are appointed by the president of the United States and confirmed by the U.S. Senate. They even have a page on their website that discusses their commitment to openness and transparency in their regulatory activities.

That being said, the nuclear industry’s high levels of performance, reliability and safety are all due to the strict regulatory oversight and function that the NRC serves. The NRC helps the industry to focus on safety, training, regulatory compliance and continuous improvement. The U.S. commercial nuclear industry is arguably one of the most strictly and thoroughly regulated industries in the nation, and the NRC is a model to other countries that are developing their nuclear energy programs.

---

Altogether, I appreciated the fact that O’Brien and Palfreman held the chat to further discuss nuclear energy issues, but I felt that several of the assertions warranted further clarification (as previously explained). I really like the concept of holding these chat-type forums because I think they add context to some of the larger policy debates that are country currently faces.

Read the full transcript of the chat here. See our other blog posts on the FRONTLINE report here.

Their opinions closely mirrored our October 2011 public opinion poll which found that 62 percent of respondents said they favor the use of nuclear energy as one of the ways to provide electricity in the United States.

The chat’s audience also said that their opinions about nuclear power were not influenced by Tuesday night’s documentary:

This survey result really only proves one thing—that people are generally distrustful of media reports, but interested enough in the subject matter to take part in an online chat at 1 o’clock on a Wednesday afternoon!

During the chat, people posed questions on a variety of topics, including: building advanced reactors, how other countries (namely Japan and Germany) plan to meet their electricity demands and carbon reduction goals while reducing the number of nuclear plants, and how nuclear energy facilities prepare for emergencies. I took part in the one-and-a-half hour chat and provided several comments to help build on the discussion and add facts to the debate, but none of my comments were accepted or posted by the chat’s moderator. Although I am not surprised that my comments were not accepted (since I had “NEI” next to my name), I am hopeful that they will at least provide the reporters with more context to the bigger picture.

Below are a few areas where I think the discussion should have warranted a little more explanation/clarification.

1) The “Moribund” Nuclear Industry & Aging Nukes

There are two problems with this statement. First, I think it is unfair to call the industry “moribund” when there are currently 12 combined license applications that are under active review by the Nuclear Regulatory Commission to build 20 nuclear plants and new designs have either been approved (Westinghouse Electric Co.’s AP1000) or are still in the design stages in this country. Companies spend several years either designing new reactors or working to build reactors at a given site, so to equate the industry with “dying” or “inactivity” is simply untrue.

Second, and this is a point that we keep coming back to on the blog and on our website, it is important to understand that 40-year licenses for nuclear plants were never meant to be an indicator of a plant’s safe operation. The 40-year time period was simply chosen to parallel the financing amortization period for a plant. The NRC’s website explains:

The Atomic Energy Act and NRC regulations limit commercial power reactor licenses to an initial 40 years but also permit such licenses to be renewed. This original 40-year term for reactor licenses was based on economic and antitrust considerations -- not on limitations of nuclear technology.Nuclear plants are continually undergoing maintenance and upgrades so that they are equipped—no matter their age—to meet all of the NRC’s safety regulations. So, whether it’s day one or day 14,600, rest assured that each of the nation’s nuclear plants are meeting the NRC’s stringent safety requirements or else they will be subject to federal disciplinary actions, including up to the shutdown of a reactor until safety improvements are made.

2) Germany’s Nuclear Energy Situation

The nation’s nuclear power plants are among the safest and most secure industrial facilities in the United States. See for yourself. But, if you do not agree with that statement, I still think it’s important to look at the facts before making a rash decision.

Just yesterday, Siemens, which built all of Germany’s 17 nuclear plants, estimated that an exit from nuclear energy could cost the European country’s energy consumers or taxpayers as much as 1.7 trillion euros ($2.15 trillion) by 2030. Much of that estimate assumes a strong expansion of renewables, with feed-in tariffs being the biggest chunk of costs, a Reuters article reports.

Besides the high costs, cutting nuclear energy from the country’s energy portfolio will mean more carbon emissions. One of our recent blog posts quotes Laszlo Varro, the head of the gas, coal, and power markets division at the International Energy Agency, who estimates that a nuclear-free Germany could cause a 25-million-ton annual increase in CO2 emissions, mainly because of the large shift to coal power that would be needed to cover the shortfall. We also referenced a Breakthrough Institute report on our blog that predicts that Germany’s carbon emissions could rise by as much as 14 percent of the country’s 2008 total carbon emissions. These estimates do not bode well for a country that aims to reduce global greenhouse gas emissions. (They also do not bode well for O’Brien’s argument because later in the chat he says that “anything is better than coal.”)

3) Small Reactors

According to some government officials and vendors I’ve talked to recently, small reactors are—the next “big” thing. Peter Lyons, the U.S. Department of Energy’s assistant secretary of nuclear energy, just yesterday said that research will be moving forward this year toward further development and design certification of small nuclear reactors. The Tri-City Herald reports:

If there is enough demand for the small plants, large numbers could be built in a factory and then one or more would be transported to sites for use, he said. More modules could be added as needed for electricity production.If that’s not enough, Congress has certainly indicated with a restoration of $67 million in its 2012 budget that they are still interested in the development and licensing of small reactors. At NEI, we continue to see more interest in small reactors.

The factory model has potential to be more economical, and quality could be more readily controlled in a factory, Lyons said.

4) Energy Conservation

Although I don’t have any immediate statistics at my disposal, I can assure you that conservation efforts will never be enough to meet growing electricity demand. The U.S. Energy Information Administration currently forecasts that electricity demand is growing at a rate of about 1 percent per year and that the United States will need 24 percent more electricity by 2035. To meet that demand, the electric utility industry must invest between $1.5 trillion and $2 trillion in new power plants, environmental controls, and transmission and distribution lines.

I do not think that unplugging our electronic devices, kitchen appliances, etc., will be enough to make up the difference in electricity supply. (I also personally don’t think the image of people wearing sandals and tee-shirts and using fans instead of A/C—like O’Brien describes that they are currently doing in Japan without the added electricity from their nuclear plants—will ever be a possibility in American culture.) However, I do think that we are on the cusp of a revolution where utilities are developing smarter ways for people to use electricity to reduce cost and alleviate daily demand through smart meters. Some are doing it very well (see a recent report by the Massachusetts Institute of Technology for examples).

5) Relationship Between NRC & Nuclear Industry

I think this comment distorts the important work that the NRC performs each day. It is an independent agency that strives for transparency. Its five commissioners are appointed by the president of the United States and confirmed by the U.S. Senate. They even have a page on their website that discusses their commitment to openness and transparency in their regulatory activities.

That being said, the nuclear industry’s high levels of performance, reliability and safety are all due to the strict regulatory oversight and function that the NRC serves. The NRC helps the industry to focus on safety, training, regulatory compliance and continuous improvement. The U.S. commercial nuclear industry is arguably one of the most strictly and thoroughly regulated industries in the nation, and the NRC is a model to other countries that are developing their nuclear energy programs.

---

Altogether, I appreciated the fact that O’Brien and Palfreman held the chat to further discuss nuclear energy issues, but I felt that several of the assertions warranted further clarification (as previously explained). I really like the concept of holding these chat-type forums because I think they add context to some of the larger policy debates that are country currently faces.

Read the full transcript of the chat here. See our other blog posts on the FRONTLINE report here.

Comments

Please update your table of new reactor projects. This table may have led to your statement that there "are currently 20 license applications that are under active review by the Nuclear Regulatory Commission." There are, in fact, 12 COL applications and two ESP applications under active review. Five other COL applications have been suspended at the applicants' request, and one other (Exelon's Victoria) was withdrawn and replaced by an ESP application. Your table also includes the Clinton ESP (no COL application is planned by Exelon), and projects for which no application has yet been submitted (Amarillo, Blue Castle, Southern's greenfield, and Southern Ohio).

Why do you jump to that conclusion? The question was whether the show changed viewers' opinions; they didn't say WHY their opinion did not change.

Your right to editorialize against the press, of course -- but stick to claims you can back, please.

1. The chat participation was skewed towards people with a strong (positive or negative) interest in nuclear power, for whom the documentary made no difference.

2. Documentaries are not as effective at changing minds as their creators would like to think.

3. This documentary wasn't really aimed at changing views; the diverse material meant that people could take any message they wanted from it.

4. Most people prefer not to think that they are easily influenced and rationalize mind-changing as a shift in emphasis = "I didn't really change my mind".

Thanks for the catch! You're right--I read the numbers too quickly and grabbed the wrong one. I'll correct it in the post.

Also, to Anonymous's point,

You are right that drawing that conclusion is a bit of a stretch. However, during grad school I once had a class where we looked at the credibility/trustworthiness of sources--from Congressmen to news media to industry wonks to educators, etc. I remember that news media was somewhere in the middle, and industry reps (like me!) along with Congress was much lower. Professors and technical experts (like engineers, doctors) always scored the highest in terms of public trust.

Edelman routinely posts information on their website and has a "trust barometer" among industries & corporations. I think you might find it interesting: http://www.edelman.com/trust/2011/.