Vermont’s only nuclear plant can remain open beyond its originally scheduled shutdown date this year, despite the state’s efforts to close the 40-year-old reactor, a federal judge ruled Thursday.

In February 2010, Entergy, Vermont Yankee’s owner, discover a tritium leak at the plant. Tritium is a mildly radioactive form of hydrogen that is incorporated into water molecules. It is found in nature and as a byproduct of fission processes. Health effects are minimal and present only if ingested in large amounts.

In any event, none leaked outside the plant nor was there any measureable amount in drinking water at the plant. Regardless, in March, the state legislature voted to close the plant due to the leak.

Now, that was controversial. In all instances, only the NRC can close a plant due to a safety concern. But Vermont and Entergy had signed an agreement that said the plant could operate only if the state issued a certain document – the March vote essentially withheld that document.

In March 2011, the NRC approved a 20-year license extension for Vermont Yankee – if Vermont failed to close it.

In April 2011, Entergy, through two subsidiaries, filed suit in U.S. District Court to prevent the closure contending that the action is preempted by federal law and violates both the supremacy clause and the commerce clause of the U.S. Constitution.

And that is the suit that has now prevailed. The Washington Post story quoted above is light on details, but it does mention a few interesting tidbits:

Entergy argued that the state was moving to close Vermont Yankee out of concerns over plant safety, an issue that the state agreed is solely the NRC’s jurisdiction. The state maintained it had other reasons, including that Vermont Yankee didn’t fit in to its energy plan and was likely to be increasingly unreliable as it aged.

I had assumed that Vermont believed it could close the facility for any reason, but apparently, that isn’t true. And the story doesn’t really suggest if the judge decided that federal law trumped state law.

We’ll pass along more details as we have them. In the meantime, a win is a win.

The losing side in federal court was expected to appeal [U.S. District Judge J. Garvan] Murtha’s decision to the 2nd U.S. Circuit Court of Appeals in New York, though it was not immediately known whether the state would follow through with that.

And we’ll probably has a better sense of how Vermont will proceed in the days to come, too.

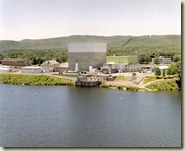

Vermont Yankee

Comments