With audacious hypocrisy, American pro-nuclear pundits have been indulging in the familiar sport of losers – the relentless bashing of the more successful.

This should pique our interest. Bashing the more successful is a regular sport over here.

With nuclear energy rapidly losing favor around the globe, the industry’s boosters have taken to blaming countries that have rejected it for worsening climate change. Top of the target list? Germany, which has vowed to generate 80-100% of its electricity from renewable energy sources by 2050; and Japan, which chose this month not to restart the last of its 54 nuclear reactors.

Of course, Germany still has some functioning nuclear plants. Japan does not currently.

The accusation that these countries are worsening climate change is pretty rich coming from US commentators. By any measure – whether calculating total CO2 emissions or per capita – the US is one of the worst offenders on the planet.

Oh, that’s it. The tunnel vision part comes in here, as the assumption is that it’s all about electricity generation. It’s not – cars and animals do an awful lot of emitting and we have a lot of both in the United States. It’s not always about the electricity.

And the irony? Germany is currently replacing lost nuclear energy with – nuclear energy. France made about $400 million from Germany in the last nine months by selling it electricity – generated largely by nuclear energy.

And Japan? Well, it is importing a lot of fossil fuels now and hoping it can keep the lights on this summer. But really, while pundits may have dinged them on carbon emissions – the real problem is the economic impact.

Shutting down nuclear power permanently would reduce economic output by 2.5 percent per year -- equivalent of over 14 trillion yen -- over the next decade.

Factory output would probably fall 2.4 percent on month-on-month in July 2012 and 1.2 percent in August.

I’m cherry picking here – there are mitigating factors – but there are no mitigating factors to this one:

Power generation costs would rise by over 3 trillion yen ($38 billion) per year if Japan replaced nuclear energy with thermal power generation. Higher electricity costs would lift production costs by 7.6 trillion yen per year. The ministry did not provide estimates of how such an increase in costs would affect economic output.

Yoshito Sengoku, the president of the ruling party in Japan, called ending all nuclear power production the equivalent of “mass suicide.”

That’s not a pundit talking.

---

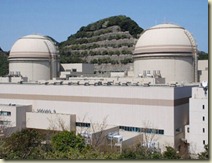

The local assembly in the Japanese town of Ohi that hosts Kansai Electric Power Co's Ohi nuclear plant agreed on Monday it was necessary to restart two offline reactors, its chairman said.

Power shortages are a concern as all 50 of Japan's nuclear power plants have been shut down following routine maintenance checks in the wake of Fukushima, with the country's last operating reactor going offline on May 4th.

Well, there’s a mitigating factor.

Ohi – reopening.

Comments