Still, a good idea is a good idea, so it’s interesting to see Great Britain explicitly tie their electric trains to nuclear energy.

The majority of Britain's trains will be indirectly running on nuclear power for the next 10 years following Network Rail's agreement to a £3bn deal with EDF to supply electricity to the railways.

“Indirectly running.” That sounds like a nice way of saying, “We cannot know where the electricity is coming from,” which is true, “but a lot of it is nuclear energy,” which is also true. What it really means is that only 50 percent of the train service is electric, though that is expected to increase to 75 percent in 2020.

Still, there is a bit more to it – it isn’t just a symbolic gesture.

EDF Energy operates 14 Advanced Gas-cooled Reactor and one pressurized water reactor, totaling 9548 MWe in generating capacity. It has advanced plans for a new EPR unit at Hinkley Point, which it wants to be the first of four.

EDF owns two coal plants, two natural gas plants and a couple of wind farms – though EDF is not one of the big boosters of renewable energy on the isles – but the focus is definitely and explicitly on nuclear energy, with eight facilities generating about 9000 megawatts, and Network Rail insisting that the electricity it will use must come directly from nuclear energy.

The deal has positive implications for both British Rail and EDF. For Network Rail:

Network Rail will purchase power "up to ten years in advance" under the deal, a privilege which the companies said "helps to deliver greater certainty over costs and significantly reduce exposure to short term, volatile energy prices." This kind of long-term arrangement is made possible by the economics of nuclear power, which feature high costs for construction and capital but low and predictable fuel and operating costs.

Very true. And for EDF:

For EDF Energy, CEO Vincent de Rivaz called the deal "a massive vote of confidence in our nuclear-backed energy." He said, "The deal places nuclear energy at the heart of the UK's infrastructure for the next ten years and serves to underline that nuclear power is part of everyday life in Britain."

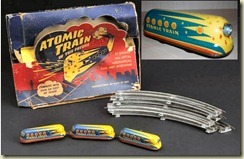

I wonder if British Rail will incorporate this into selling the service – something like Atomic Trains to Bramford or Neutron Expresses to Oxford or perhaps it will just reference its green profile in the literature. I vote for the atomic train.

Comments

James Greenidge

Queens NY