But let’s do some grousing and correcting anyway, since we think some media outlets are looking for a hook for the story that the facts on the ground do not fully support. For example, here’s the Washington Post:

Republicans, who have called for building as many as 100 new nuclear power plants, hailed the president's move as evidence that he has accepted their argument. Sen. Lindsey O. Graham (S.C.) called it a "good first step" that would pave the way for progress on climate and energy legislation.

And this is the Post’s headline:

Obama to help fund nuclear reactors : GOP energy initiative

And here’s the New York Times:

The announcement of the loan guarantee — $8.3 billion to help the Southern Company and two partners build twin reactors in Burke County — comes as the administration is courting Republican support for its climate and energy policies.

Now, really, we have no problem with characterizing this as a partisan issue in which Obama is bending to the will of the Republicans – Obama has even used it as an example of reaching across the aisle - but that would be closer to the truth if this were President Clinton instead. Nuclear energy might be said to have had more of a partisan profile in earlier decades, but that isn’t nearly as true anymore.

For example, here’s House Majority Leader Steny Hoyer (D-Maryland):

I commend President Obama’s commitment to the development of nuclear energy as a clean and safe energy alternative and today’s announcement of a federally-backed project to build the nation’s first nuclear facility in almost 30 years. Enhancing America’s nuclear capacity is a critical component of our strategy to develop clean alternative energies that create jobs and reduce our dependence on foreign oil.

That doesn’t sound too conflicted, does it?

Now, in sum, we really appreciate these stories – they’re balanced in a way that can seem a little “he said-she said” and the drama of Congressional hyper-partisanism is something we will just have to accept as a narrative even if the reality might be more complex. But the stories do give the news its due – this is a sea change in energy policy.

And it is bipartisan.

---

Who was Alvin Ward Vogtle, Jr., after whom the plant is named? According to his 1994 New York Time obituary, he was:

A former president and chairman of the Atlanta-based Southern Company.

Well, that makes sense. But here’s what really caught our eye in the obituary:

Captured and sent to a prisoner of war camp in Germany, he made four unsuccessful escape attempts. On his fifth try, in 1943, he reached safety by scaling a 14-foot barbed-wire border fence and crossing the Rhine to Switzerland.

That’s dramatic, not to mention heroic. Might make a good movie, no?

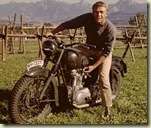

Virgil Hilts ([Steve] McQueen's character) was supposedly based on Alvin Vogtle - but while he was at Stammlager Luft III, he did not escape with the other men.

Vogtle’s wikipedia page says this too.

Maybe, maybe not. Our guess: Paul Brickhill, the author of the book The Great Escape, cherry picked elements from several lives to craft his character. If one of those was Vogtle, fine. But Vogtle doesn’t need the boost – he did what he did, and it’s enough. (Still, we hope he was able to say that he was played by Steve McQueen in a movie – why miss the opportunity?)

Further tidbit: the name is pronounced Vogle – silent “t.”

We’ll resist calling this the big dig at the Vogtle site. We love seeing it, though. And Steve McQueen – actor, racing enthusiast – and Alvin Vogtle?

Comments