President Obama … proposed allowing oil and gas drilling for the first time in large swaths of water off the East Coast, in the eastern Gulf of Mexico and potentially off Alaska.

Not only because it isn’t our brief, but because we think arguments against it (environmental havoc) and for it (oil jackpot) are wildly overstated. We have to hope the government doesn’t go crazy handing out leases to oil companies – these are taxpayer owned waters, after all – and it seems the plan takes account of the states that will be affected:

Obama pledged to protect areas vital to tourism, the environment and national security and to be guided by scientific evidence.

And we didn’t find a reference, but we hope states can opt out. And that’s about all we’d say about it.

"Where's our half in all of this?" said Jim Metropulos, senior advocate for the Sierra Club in California. "Promoting offshore drilling and nuclear energy crowds out the chances that something like renewable energy gets developed."

And:

When it comes to energy, conservatives are crazy about two things: nuclear power and offshore drilling. Now Obama has agreed to both. But does he seriously think this will "help win political support for comprehensive energy and climate legislation"?

And:

[The drilling decision] follows the decision to massively expand loan guarantees for nuclear plants. As far as anyone can tell, these concessions to conservative ideas on energy have not attracted Republican allies for the administration's preferences on energy, and in fact, the center of this issue seems to be moving rapidly to the right.

Pairing drilling with nuclear energy as a means of bashing both as sops to conservative politicians seems exactly wrong. Throughout the climate change debate, nuclear energy has garnered support from across the ideological spectrum while oil drilling remains controversial – drilling answers, if not as much as proponents allow, to the energy security issue while threatening, if not as much as its opponents contend, environmental irresponsibility. (We’d also be careful not to too tightly link environmentalism a priori to liberal ideology – approaches to it, perhaps.)

Meanwhile, nuclear energy has found favor across the Congressional aisles because it provides what’s most needed now: carbon emission free energy and lots of it (and energy security, too.) Drilling does not offer that benefit.

Where we think the truth lies is closer to this bit from a New York Times editorial:

Mr. Obama noted pointedly and correctly that increased oil and gas drilling cannot possibly address the country’s long-term energy needs. It should be seen as just one element of his broader energy strategy — including fuel efficiency standards to be announced on Thursday, big investments in alternative fuels in the stimulus package and new loan guarantees for nuclear power.

So no more yoking drilling to nuclear energy, either practically or ideologically. One thing is not like the other.

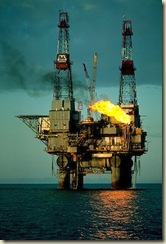

An off-shore oil rig. The shore this one’s off is Alaska.

Comments

Anti-nukes are not very respectful of truth, to put it mildly.

As a professional military officer who has spent a career recognizing the alignment between the need for energy and the world conflicts of the past 100 years, I sure wish that more of what the US needed came from our own resources. Based on my rather limited understanding of how oil reservoirs formed, I would expect that areas that have been kept off limits contain a reasonable quantity of oil that is worth many hundreds of billions of dollars.

Of course, I much prefer using nuclear energy wherever possible, but even in my most creative times, I have not figured out how to reasonably power trucks, bulldozers, cranes, planes and automobiles using fission either directly or indirectly. (Trains are a different matter.)

I have not figured out how it became "conservative" to recognize that reliable energy is an important ingredient in a successful industrial society where people still make things. I happen to be a pretty liberal guy who likes public schools, public parks, labor, and functional communities. I tend to believe that progressives in the traditional sense should like both nuclear energy and well managed drilling in domestic locations.