|

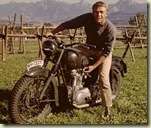

| Steve McQueen |

One of the main characters in the film is U.S. Army Air Force pilot Virgil Hilts. He was played by Hollywood legend Steve McQueen. Virgil Hilts was just a fictional character. But Alvin Vogtle was the real deal.

I'll let NEI's Mark Flanagan pick it up from here in an excerpt from a 2010 blog post about the federal loan guarantees for the construction of two AP-1000 reactors at Plant Vogtle in Georgia.

* * *

Who was Alvin Ward Vogtle, Jr., after whom the plant is named? According to his 1994 New York Time obituary, he was:A former president and chairman of the Atlanta-based Southern Company.

|

| Vogtle (3rd from right) & his POW bunk mates. |

Captured and sent to a prisoner of war camp in Germany, he made four unsuccessful escape attempts. On his fifth try, in 1943, he reached safety by scaling a 14-foot barbed-wire border fence and crossing the Rhine to Switzerland.That’s dramatic, not to mention heroic. Might make a good movie, no?

* * *

As Mark later mentioned, the screenwriters, as is their wont, took some liberties with the exact details about Vogtle's escape attempts, but the real story leaves no doubt: Vogtle was a true American hero, and our industry is proud that the plant bears his name.

Comments