Last week on the Daily Show, former President Bill Clinton asserted that wind and solar are projected to be cheaper than coal in 2-5 years and that both wind and solar are cheaper than nuclear right now.

PolitiFact dug into the numbers and found that the President's statements were only half true. We took their analysis one step further and argue that the President’s statements were mostly false.

PolitiFact cites the Energy Information Administration (EIA). EIA is a credible source for comparing levelized electricity costs for new generation technologies. PolitiFact is correct that solar is much more expensive than most all other generating technologies including nuclear. When it comes to the cost of wind, however, we think PolitiFact should take another look.

When delving into the numbers, PolitiFact only looked at one set of single-point cost estimates from EIA. In reality, though, the cost of building and operating power facilities falls in a range that depends on many factors such as financing, transmission requirements, available natural resources for renewables and performance of the operating companies.

Wind turbines, like all other technologies, have a range of costs based on many variables. EIA shows that the upper end of wind’s cost range is more expensive than the lower end of nuclear’s cost range. On the bottom of EIA’s page, a range of costs for each technology is provided (chart below).

As shown above, the low end of nuclear’s cost range ($109.70/MWh) is lower than the high end of wind’s cost range ($115/MWh); therefore wind is not always cheaper than nuclear.

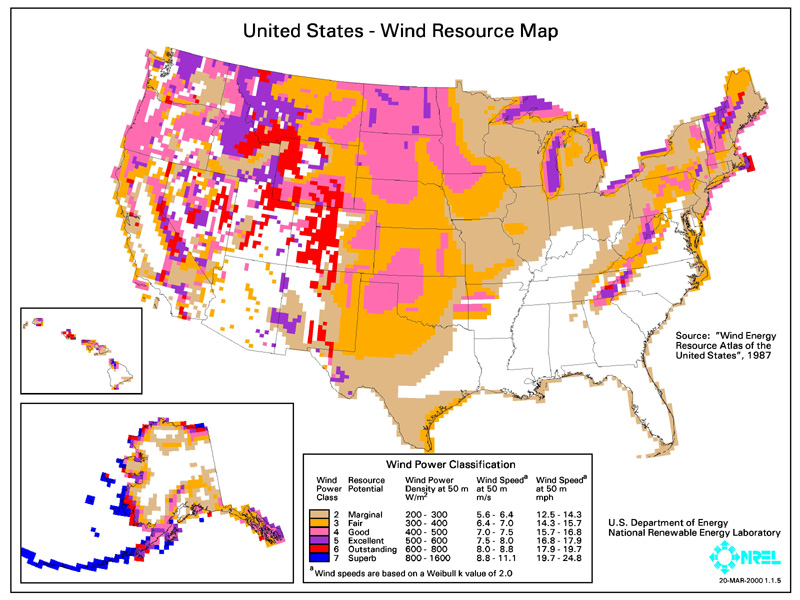

Further, the amount of wind that can be built is limited to specific places in the U.S. that receive adequate wind flow (see map below).

A substantial amount of wind cannot be built in places such as the Southeast due to a lack of natural resources. Areas with low wind resources will produce less electricity from installed turbines which in turn cause higher levelized costs. Here are SCANA’s estimates for its region which show nuclear is cheaper than gas, coal, wind and solar (different incentives included for all):

![[image3.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj52tmOpU74MSCci8tgg9s_Nnk5mS3Fg27bqfZW9NisTPEsoaVllB8g9NwS0weNiho71TI6rdys1Qw4TloMyBWwTyc_Bn7gjNrk0okeMiBa-mkwsGZOUVWgwUMKdNNXyFGuEe92AQ/s1600/image3.png)

Currently, 104 nuclear reactors (101 gigawatts) generate 20% of the country’s baseload power at low operating costs. This compares to 40 GW of wind and 1 GW of solar generating 2.2% and 0.0003% of the country’s electricity, respectively, at intermittent times.

The folks at PolitiFact should reconsider their conclusion about former President Clinton’s statements and change it from Half True to Mostly False.

Comments

The duty cycle for intermittent renewable resources of wind and solar is not operator controlled, but dependent on the weather or solar cycle (that is, sunrise/sunset). The availability of wind or solar will not necessarily correspond to operator dispatched duty cycles and, as a result, their levelized costs are not directly comparable to those for other technologies (even where the average annual capacity factor may be similar).

Obviously, it depends upon what the meaning of the word "cheaper" is. ;-)

Are the costs of disposal or of a closed fuel cycle considered begin considered for nuclear? Disposal or recycling of turbines and PVC's?

Further, cost is only one dimension of the discussion on energy production. Security, reliability and environmental impact must certainly also be considered.

Considering the frequency of capacity factor comments about renewables... I'd expect a bit better attention to detail from you all. It's the uninformed, manipulative nuclear-bashers who descend into 'creative wordplay' to achieve their objectives. Nuclear aspires to a higher standard, no?

Anon #3, actually both of us are wrong. Nuclear provides 20% of the country's electric generation; not 20% of baseload power. Baseload power pretty much only includes nuclear and coal so nuclear's fuel share would be much higher under your statement. A higher standard, sure, but kind of fretting about a little thing, eh?

They used our USA biased numbers. Really, our government lies, you didn't know?

http://www.ncwarn.org/wp-content/uploads/2010/07/NCW-SolarReport_final1.pdf

http://www.sourcewatch.org/index.php?title=Comparative_electrical_generation_costs

shows overlap in solar and nukes costs at around 13 cents.

http://www.scientificamerican.com/article.cfm?id=sunergy-offers-5-cent-solar-billing-2009-12

http://www.solarnovus.com/index.php?option=com_content&view=article&id=3996:have-cost-estimates-for-solar-been-too-conservative&catid=52:applications-tech-research&Itemid=247

http://solar.gwu.edu/Research/EnergyPolicy_Zweibel2010.pdf Great article about price of solar now 3$/W installed. last 100 years, 1-2 cents pwer KWH after the first 20 years and the loan is paid off.