The U.S. Nuclear Regulatory Commission is poised to award Scana Corp. (SCG) a license to build two reactors in South Carolina, the second such action after a three-decade drought.

The NRC will vote March 30 on the Cayce, South Carolina- based company’s proposal to build two units at its existing Virgil C. Summer plant, about 26 miles (42 kilometers) northwest of Columbia, the agency said today on its website.

This seemed likely to happen after the approval for two reactors at Vogtle in Georgia last month, but that didn’t happen. And even in this instance, the NRC calendar marks this event as tentative. So we’ll see.

These affirmation hearings take place after all issues have been advanced. This one is scheduled for 1:25 pm and will probably be done by 1:30. It’s basically a quick okay.

Bloomberg adds this detail:

The reactors may be among the last built in the U.S. this decade, as a glut of cheap natural gas has discouraged companies from investing in nuclear energy and other forms of generation.

So yes, something in the punch bowl does smell bad. There are a bunch of companies with license applications In the hopper, so we’ll see how this dour little prediction works out.

---

Okay, Here’s the question from Gallup.

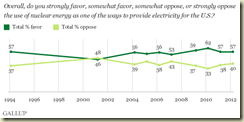

Overall, do you strongly favor, somewhat favor, somewhat oppose, or strongly oppose the use of nuclear energy as one of the ways to provide electricity for the U.S.?

The answer in 1994, was 57 percent (combined favor). Closely after the accident at Fukushima Daiichi, this withered to, well, 57 percent. Today it is – 57 percent. Now after the accident, some of the uncommitted vote moved to oppose territory. So nuclear energy wasn’t losing friends but it wasn’t winning them either. This is a bit of a problem, as strong opposers are as tough to dislodge from their position as strong partisans. So it isn’t all good news.

But it’s mostly good news. There’s more summary at the link.

---

In an otherwise sour article in the New York Times, economist Nancy Fobre lets the mask slip just a little, especially in light of the Gallup survey:

Yet the industry has proved remarkably successful at garnering public support in the United States, ranging from public insurance against accident liability to loan guarantees.

Even this isn’t altogether fair, but the admission that nuclear energy has garnered “public support” is more than you’ll usually see from an anti-nuclear advocate. Crediting that support to the nuclear industry is probably something NEI should show its board of directors, but we shouldn’t underestimate the power of the facilities themselves.

People who live around them tend to like them even better than the general public. Not only are they literal powerhouses, but they are economic powerhouses, too, and do a lot of good for their communities.

I know Fobre likely means public financial support, but it’s been pretty good at plain old public support, too.

From Gallup. Click to enlarge.

Comments

James Greenidge

Queens NY

Huh?

For at least the last year, NEI officials have agreed with "this dour little prediction," and have been saying (at least publicly) that there are not likely to be more than 4-6 new units operating in the US before 2020.

The best way to continue long term investment in new nuclear power plants and renewable energy is by legislatively mandating through Congress that all utilities produce at least 50% of their electricity from carbon neutral resources by 2020 (several utilities already meet this level) and at least 90% by 2030-- with the penalty of a 15% energy sin tax on all US utilities that fail to reach the mandated levels.

Its that simple, IMO!

Marcel F. Williams

According to the NRC's application schedule, the next are Levy County (2012), Lee and Fermi (2013), Turkey Point (2014), and Comanche Peak (2015?). And others, for which the schedule is "being revised" or the review has been suspended pending higher gas prices.

http://www.nrc.gov/reactors/new-reactors.html