You have to love Fox News. Even in a fairly straightforward story about small reactors, it amps up the controversy, even when there is none:

A boon to the economy? Or a boondoggle? That's the debate raging over a new nuclear technology that -- depending on your perspective -- is either a game-changer in electrical generation, or a failure-in-the-making that will fleece taxpayers for a half-billion dollars.

If there is any kind of debate, these really are not the terms of it – small reactors are neither a game changer nor a potential fleecing. They are a promising application of a technology – and they interest the federal government – and that’s it. Some of the players are new, some are veterans, but none have been shown as potential swindlers – I suppose investors can always be swindled, but the government has no reason to believe it. Nor does Fox.

This bit gets to the nub of the story in an interesting way, although I don’t think the interviewee is answering the question the reporter assumes.

For supporters, the goal of replacing coal-fired plants is key. In his June speech on climate change, President Obama talked about shutting down dozens of older coal plants, which left open the question of how that electricity would be produced.

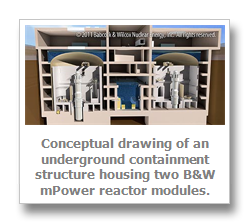

Charlotte, N.C.-based Babcock and Wilcox is betting millions of dollars that the answer to that question -- at least in part -- is small modular reactors.

"Small modular reactors are all about taking the risk out of the equation for nuclear," said Christofer Mowry, president of B&W's mPower division. "And that's what the industry wants -- they want to de-risk nuclear. They like nuclear because nuclear offers what no other source of energy does, which is basic, reliable, clean energy."

I think Mowry means financial risk – I doubt Babcock & Wilcox believes that nuclear energy is unsafe – and really, nothing here suggests B&W has its eye on coal. Or that the supporters of small reactors have that in mind, either. Coal and nuclear have co-existed for a long time without getting in each other’s way, whatever you may think of either, and most electricity production combines have both in their portfolios. The government is offering billions of dollars in loan guarantees for fossil fuel projects.

But Mowry is dead on about the appeal of small reactors. Although the financial risk is still rather nebulous, logic dictates that a small reactor that can built in a factory and co-located at a pre-existing facility will have lower costs withal. How much remains to be seen.

---

Here’s the controversy:

Ryan Alexander, president of the group [Taxpayers for Common Sense], sees the potential for a nuclear version of Solyndra, the solar power company that went belly up after taxpayers poured a half-billion dollars into the company.

"There are a lot of cost questions that we don't know anything about, and it just seems like this is not going to happen without it being just incredibly expensive. So we don't want to keep putting taxpayer dollars into this idea that may or may not happen," she told Fox News.

TCS is a valuable organization for its work tracking Congressional earmarks and the donors who buy them, but frankly, if something involves government money, TCS will be very critical of it. That’s fine – that’s what it does – but it’s also predictable and not very controversial. But if you want to gin up conflict, you can always find a way.

Despite all the quibbling, this is really a pretty good story though one has to cut through the ideological fog to get to it.

Comments