TEPCO has a number of links and updates available showing the activities going on at Fukushima-Daiichi. Below is a 13 minute video provided by the company and uploaded to YouTube by Daniel Garcia who we mentioned last month.

There are quite a few good scenes of the work being done as well as the work still yet to be done. One of the more interesting parts was at about the 11th minute where you can see the workers busy changing shifts in their suits.

On top of the video, TEPCO has a simple 19 page pdf with pictures describing all of the countermeasures being taken to resolve the issues. Pages 1-5 describe the actions needed to cool units 1-3; pages 6-8 discuss actions being taken on unit four’s spent fuel pool; and the rest of the pages discuss mitigation steps to decontaminate and monitor the environment, plans for the installation of a temporary tide barrier in case of other tsunamis, and radiation monitoring data. Many of the pictures in the pdf and video above can be found here.

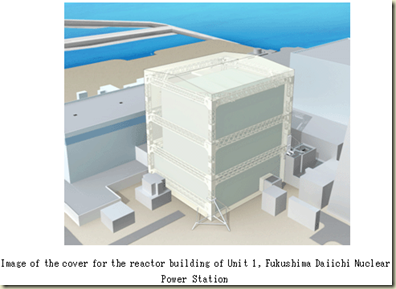

Also worth noting is that TEPCO has begun work on clearing space to install a temporary cover for unit 1. Installation is planned to begin in June.

And last to note, it’s been more than a month since we mentioned Daniel Garcia’s daily chart updates at his blog. Pasted below is one of his latest charts showing the revised water level for unit 1 after TEPCO fixed their monitoring gauge. Similar water levels for units 2 and 3 have not been ruled out yet.

Anyways, lots of info above to explore so have at it. Hat tip to Dan Yurman twittering at ANS for the links.

Comments