60 Years of Energy Incentives – An Analysis of Federal Expenditures for Energy Development from 1950-2010

In 2008, NEI published a study based on an analysis by the Management Information Systems, Inc. that detailed the amount of subsidies that go to each energy source. The study has just been updated and now shows 60 years of energy incentives. Here’s the intro:

With concern about the price and availability of energy increasing, public interest in the role of federal incentives in shaping today’s energy marketplace and future energy options has risen sharply. That interest has met with frustration in some quarters and half-truths in others because of the difficulty in developing a complete picture of the incentives that influence today’s energy options.

The difficulty arises from the many forms of incentives, the variety of ways that they are funded, managed and monitored, and changes in the agencies responsible for administering them. It is no simple matter to identify incentives and track them through year-to-year changes in legislation and budgets over the 50-plus years that federal incentives have been a significant part of the modern energy marketplace.

…

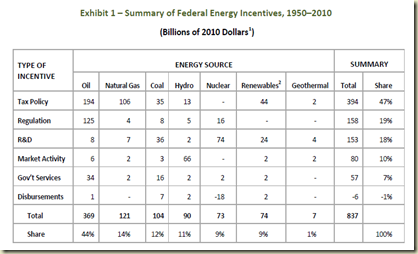

The findings indicate that the largest beneficiaries of federal energy incentives have been oil and gas, receiving more than half of all incentives provided since 1950. The federal government’s primary support for nuclear energy development has been in the form of research and development (R&D) programs, one of the more visible types of incentives identified. In the past 10 years, federal spending on R&D for coal and renewables has exceeded expenditures for nuclear energy R&D.

Below are two key charts showing the latest numbers on pages 10 and 12:

And a little bit more on page 17:

The common perception that federal energy incentives have favored nuclear energy at the expense of renewables, such as wind and solar, is not supported by the findings of this study. The largest beneficiaries of federal energy incentives have been oil and gas, receiving more than half of all incentives provided since 1950.

The federal government’s primary incentive to nuclear energy has been in the form of R&D programs, one of the more visible types of incentives identified. Since the end of funding for the breeder reactor program in 1988, federal spending on nuclear energy research has been less than spending on coal research and since 1994 has also been less than spending on renewable energy research.

The analysis takes you back into some good history of U.S. energy policy since 1950. There is a telling story on renewables on page 52 and some interesting incentive figures for each nuclear technology (light-water reactors, heavy-water reactors, gas cooled, sodium cooled and others) on page 35. Make sure to take a gander at the full report.

Comments