In 2004, it took the U.S. 40.77 quadrillion BTUs to produce 3,717 billion kilowatt-hours for consumption in the residential, commercial, industrial and transportation sectors. Fossil fuels provided 69% of that energy; nuclear, 20% and renewables, 10%. About two thirds of the energy (BTUs) consumed to create electricity was lost. Why?

In 2004, it took the U.S. 40.77 quadrillion BTUs to produce 3,717 billion kilowatt-hours for consumption in the residential, commercial, industrial and transportation sectors. Fossil fuels provided 69% of that energy; nuclear, 20% and renewables, 10%. About two thirds of the energy (BTUs) consumed to create electricity was lost. Why?Electrical system energy losses are calculated as the difference between total primary consumption by the electric power sector and the total energy content of electricity retail sales. Most of these losses occur at steam-electric power plants (conventional and nuclear) in the conversion of heat energy into mechanical energy to turn electric generators. The loss is a thermodynamically necessary feature of the steam-electric cycle.

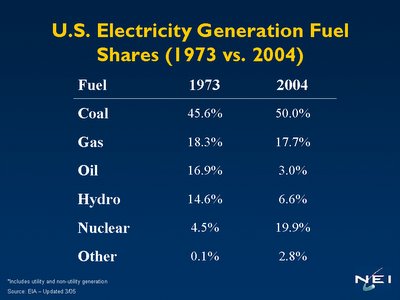

Here's a chart comparing the share for fuels used for electrical generation between 1973 and 2004. When we look at the past thirty years, we can identify three important trends:

1) Electricity generation from oil has dropped by half;

2) Hydro generation was flat while U.S. electricity consumption more than doubled; and

3) Nuclear power generation increased more than eight fold.

Fossil fuels in 2004: Coal accounted for 70% of the mix; natural gas, 25%; and petroleum and other gases, 5%.

Renewables in 2004:

Hydro power made up about 75% of renewable generation in 2004. Wind and solar made a combined contribution of 5%. Wood, waste and geothermal accounted for the rest with about 20%.

Electric Capacity

The total electric capacity in the U.S. in 2004 was 968.1 gigawatts. Fossil fuels accounted for 77%; nuclear, 10%; and renewables, 12%. Here's a table which compares total capacity to actual generation: The table shows nuclear capacity at 10% of the U.S. total. Yet nuclear contributes 20% of total electrical generation. Renewables have more capacity than nuclear, yet generate less than half as much electricity. What does that mean? It means that you don't have to build as much nuclear capacity to produce the same quantity of electricity.

The table shows nuclear capacity at 10% of the U.S. total. Yet nuclear contributes 20% of total electrical generation. Renewables have more capacity than nuclear, yet generate less than half as much electricity. What does that mean? It means that you don't have to build as much nuclear capacity to produce the same quantity of electricity.

Many people believe wind and maybe solar can provide a total solution for our future electricity needs. It's clear they can play a vital part in the equation (like solar may be able to play during peaking hours in the summer), however, they won't be sufficient in isolation.

Nuclear power has obvious advantages: It provides baseload electrical generation; forward price stability in the electrical marketplace; and promotes clean air. Once again, the choice in the marketplace shouldn't be between nuclear energy and renewables. In fact, it's pretty clear that we're going to need significant amounts of both to meet future demand.

For previous posts on EIA's Annual Energy Review click here, here, here and here.

Comments