New Energy Market Outlook Raises Projected World Oil Price Path and Adds More Coal and Nuclear Power

World oil markets have been extremely volatile for the past several years and the Energy Information Administration (EIA) now believes that the reference case oil price path in recent editions of the "Annual Energy Outlook" did not fully reflect the causes of that volatility and their implications for future oil prices. In the "Annual Energy Outlook 2006" (AEO2006) reference case, released today by EIA, world oil supplies are assumed to be tighter, as the combined productive capacity of the members of the Organization of the Petroleum Exporting Countries (OPEC) does not increase as much as previously projected. World crude oil prices, expressed in terms of the average price of imported light, low-sulfur crude oil to U.S. refiners, are projected to fall from current levels to about $47 per barrel in (2004 dollars) in 2014, then rise to $54 per barrel in 2025and $57 per barrel in 2030. The projected crude oil price in 2025 is about $21 per barrel higher than projected in last year's reference case.The higher world oil prices in AEO2006 lead to greater domestic crude oil production and increase the demand for unconventional sources of transportation fuel, such as ethanol and biodiesel.

Higher oil prices stimulate domestic coal-to-liquids production and, in some of the alternative scenarios with even higher oil prices, domestic gas-to-liquids and shale oil production. They also lower demand growth, particularly via their effect on fuel choice and vehicle efficiency decisions in the transportation sector, even though the reference case does not assume implementation of proposed new fuel economy standards that are now in the public comment process. Much of the increase in new light duty vehicle fuel economy reflects greater penetration by hybrid and diesel vehicles, and slower growth in the sales of light trucks and sport utility vehicles.

As a result of both supply and demand changes, growth in petroleum imports is expected to be less than projected last year. Net petroleum imports, which met 58 percent of oil demand in 2004, are projected to meet 60 percent of demand in 2025, considerably less than the projected 68 percent projected for that same year in the AEO2005 reference case.

Higher oil and natural gas prices than in earlier AEOs lead to a projected increase in coal consumption from 1.1 billion short tons in 2004 to 1.8 billion short tons in 2030. Growth in coal consumption is projected to accelerate after 2020, as coal captures electricity market share from natural gas and as coal use for coal-to-liquids production grows.

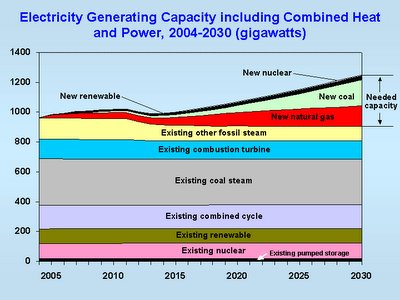

Nuclear generating capacity is projected to increase from 100 gigawatts in 2004 to 109 gigawatts by 2030, with 3 gigawatts of uprates at existing plants and 6 gigawatts of new plants stimulated by provisions in the Energy Policy Act of 2005 (EPACT2005). The new nuclear plants expected to be added in 2014 and beyond will be the first new nuclear plants ordered in the U.S. in over 30 years.

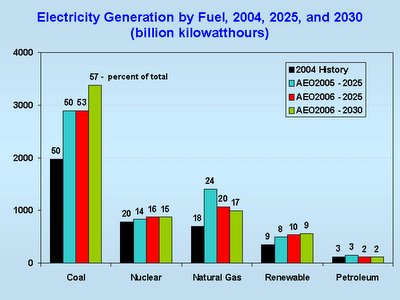

Here's some graphs from the press conference with projections to 2030. Natural gas capacity is not expected to grow as much as last year’s projections due to higher prices. Coal is expected to pick up the slack and renewables’ growth in capacity is primarily due to renewable portfolio standards in more than 20 states.

Here's some graphs from the press conference with projections to 2030. Natural gas capacity is not expected to grow as much as last year’s projections due to higher prices. Coal is expected to pick up the slack and renewables’ growth in capacity is primarily due to renewable portfolio standards in more than 20 states. In 2025, last year’s AEO projected natural gas capacity to provide 24% of the electricity generation. This year’s projections have it dropped to 20%. Nuclear and renewables both bumped up 2% and coal 3%. In 2030, coal is still projected to be the dominating fuel for U.S.’s electricity supply. For a copy of the Overview, click here (pdf).

In 2025, last year’s AEO projected natural gas capacity to provide 24% of the electricity generation. This year’s projections have it dropped to 20%. Nuclear and renewables both bumped up 2% and coal 3%. In 2030, coal is still projected to be the dominating fuel for U.S.’s electricity supply. For a copy of the Overview, click here (pdf).Technorati tags: Nuclear Energy, Energy, Economics, Electricity, Natural Gas, Coal, Department of Energy

Comments