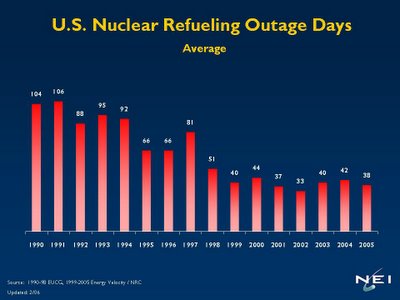

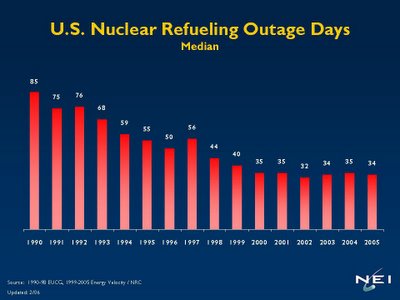

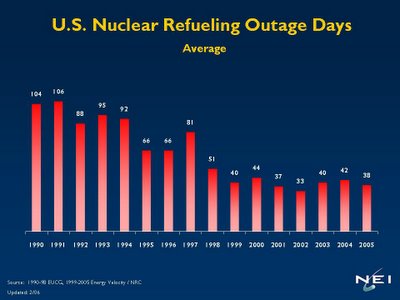

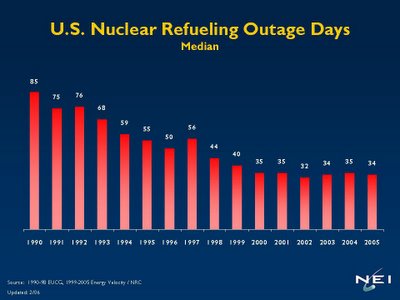

The U.S. nuclear industry's refueling outage durations have improved substantially over the past 30 years. In the 80s and early 90s, the average duration of a refueling outage was 3 months. Now it's one month. Some plants refuel in as little as 15-20 days.

Nuclear units shut down for refueling either in the spring or fall when electric demand is lowest. In 2005, 66 nuclear units (of 103) shut down for refueling outages. 43 refueled in the Spring 2005 and 23 in Fall 2005. The average refueling outage for 2005 was 38 days. The median was 34 days. In 2004, the average and median were 42 and 35.

The record for the fastest refueling outage (scroll down to near the bottom) for a boiling water reactor was Browns Ferry 3 at 14 days and 16 hours in 2002. For a pressurized water reactor it was Braidwood 2 at 15 days and 14 hours in 2003. In 2005, the fastest refueling outages were Braidwood 2 and Limerick 2 at about 17 days.

In the 80s and early 90s, the common refueling cycle was 12 months. Now, U.S. nuclear units are either on an 18 or 24 month refueling cycle. If the nuclear reactor doesn't shutdown for maintenance, it will go the entire period supplying cheap, emission free electricity.

The longest operating period between refueling outages (scroll down to Plant Performance) by a light water reactor was Exelon's Peach Bottom 3 recorded last September at 707 days. LaSalle 1, also operated by Exelon, broke that record a couple of weeks ago and is still going. Watch for the headlines!

Technorati tags: Nuclear Energy, Nuclear Power, Electricity, Environment, Energy, Politics, Technology, Economics

Nuclear units shut down for refueling either in the spring or fall when electric demand is lowest. In 2005, 66 nuclear units (of 103) shut down for refueling outages. 43 refueled in the Spring 2005 and 23 in Fall 2005. The average refueling outage for 2005 was 38 days. The median was 34 days. In 2004, the average and median were 42 and 35.

The record for the fastest refueling outage (scroll down to near the bottom) for a boiling water reactor was Browns Ferry 3 at 14 days and 16 hours in 2002. For a pressurized water reactor it was Braidwood 2 at 15 days and 14 hours in 2003. In 2005, the fastest refueling outages were Braidwood 2 and Limerick 2 at about 17 days.

In the 80s and early 90s, the common refueling cycle was 12 months. Now, U.S. nuclear units are either on an 18 or 24 month refueling cycle. If the nuclear reactor doesn't shutdown for maintenance, it will go the entire period supplying cheap, emission free electricity.

The longest operating period between refueling outages (scroll down to Plant Performance) by a light water reactor was Exelon's Peach Bottom 3 recorded last September at 707 days. LaSalle 1, also operated by Exelon, broke that record a couple of weeks ago and is still going. Watch for the headlines!

Technorati tags: Nuclear Energy, Nuclear Power, Electricity, Environment, Energy, Politics, Technology, Economics

Comments