I hear all the time that nuclear power is so heavily subsidized it can’t survive on its own. Well we’re going to finally get into this issue as well as discuss the subsidies received by all other energies and technologies.

In Issues Online which is a publication by four groups including the National Academy of Sciences, an article titled The U.S. Energy Subsidy Scorecard was published quantifying the energy subsidy topic. The article was written by Roger H. Bezdek, president of Management Information Services, Inc., an economic research firm in Washington, D.C. and Robert Wendling, the vice president of MISI.

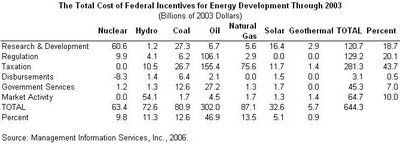

When I see claims that nuclear power gets all the subsidies, the numbers that are cited are typically only the Research and Development dollars. This has some merit because according to the table below, nuclear has received about half of the total dollars spent on R&D since 1950. However, I never see subsidies quantified by the opponents beyond R&D. This table shows subsidies beyond R&D and is from another article published by bcc Research written by the same two individuals from MISI (subscription required).

According to the first article, R&D only accounted for 19% of the total subsidies received from 1950 to 2003. The opponents paint the picture that nuclear power receives the most subsidies yet in fact, nuclear power has received about 10 percent of the total Federal incentives. From the article:

Check out these charts below from the article.Indeed, our analysis makes clear that there are diverse ways in which the federal government has supported (and can support) energy development. In addition to R&D and tax policy, it has used regulatory policy (exemption from regulations and payment by the federal government of the costs of regulating the technology), disbursements (direct financial subsidies such as grants), government services (federal assistance provided without direct charge), and market activity (direct federal involvement in the marketplace).

We found that R&D funds were of primary importance to nuclear, solar, and geothermal energy. Tax incentives comprised 87% of subsidies for natural gas. Federal market activities made up 75% of the subsidies for hydroelectric power. Tax incentives and R&D support each provided about one-third of the subsidies for coal.

As for future policy, there appears to be an emerging consensus that expanded support for renewable energy technologies is warranted. We found that although the government is often criticized for its failure to support renewable energy, federal investment has actually been rather generous, especially in light of the small contribution that renewable sources have made to overall energy production. As the country maps out its energy plan, we recommend that federal officials pay particular attention to renewable energy investments that will lead to market success and a larger share of total supply.

So if nuclear can’t survive without subsidies, what energy technology can? By our opponent’s logic; hydro, coal, oil and natural gas cannot survive without government help either. What about the other renewables and geothermal? I'll let the reader decide if they are really surviving without government help (pdf).

Price Anderson Act and the Nuclear Waste Fund

We say that the Price Anderson Act and the Nuclear Waste Fund are not a subsidy. Yet, according to some of our opponents they are subsidies. By looking at the data in the article it appears they include both of these monies in their analysis under Disbursements from the table above. However, it is not a payment by the federal government. It’s the exact opposite.

Since the industry pays for its own waste by paying one mill of a cent / kWh into the Nuclear Waste Fund, this payment is subtracted from the total subsidies received. Thus why you see a -$8.3B under Disbursements for nuclear.

Since the Price Anderson Act was created, only about $151 million have been paid out in claims by the industry ($70M for Three Mile Island and $65M by DOE). According to Wikipedia:

Power reactor licensees are required by the act to obtain the maximum amount of insurance against nuclear related incidents which is available in the insurance market (as of 2005, $300 million per plant). Any monetary claims that fall within this maximum amount are paid by the insurance company. The Price-Anderson fund, which is financed by the reactor companies themselves, is then used to make up the difference. Each reactor company is obliged to contribute up to $95.8 million in the event of an accident. As of 2006, the maximum amount of the fund is approximately $9.5 billion if all of the reactor companies were required to pay their full obligation to the fund. This fund is not paid into unless an accident occurs.And if the accident costs beyond $9.5B:

...then the President is required to submit proposals to Congress. These proposals must detail the costs of the accident, recommend how funds should be raised, and detail plans for full and prompt compensation to those affected. Under the Act, the administrators of the fund have the right to further charge plants if it is needed.Considering that the U.S.’ worst nuclear accident (TMI, 1979) paid $70M in compensation, a $9.5B cap appears to be ample enough.

Moving on. The only issue lacking in this post is information on the incentives from the Energy Policy Act of 2005. This is something I hope to cover later in the future so stay tuned for more posts. As for now, enjoy the information on energy subsidies over the past half century.

Technorati tags: Nuclear Energy, Nuclear Power, Energy, Politics, Technology, Economics, Subsidies

Comments

There's a discussion going on in Europe about subsidies for non-hydroelectric, intermittent renewable energy sources, in light of the recent revelation that the erratic nature and lack of controllability of wind generation in Germany [.pdf file --- see pages 29-32 and summary on p.51] may have contributed to the length of the November 4th European blackout.

The authors should have normalized subsidies explicitly by reporting $/unit energy, or $/kw-hr, rather than indirectly reporting it by plotting subsidy next to production.

The authors should have included the user fees that the nuclear power industry pays to the NRC. I think these fees are typically several million per plant, per year. I don't know how the nuclear power industry can be charged any expense for regulation. I've heard that the industry has complained to the NRC that user fees actually exceed the cost of regulating the industry, effectively giving the NRC extra cash to spend on whatever it likes.

When, pray tell, will someone tally up taxes paid so that they can be placed in context with subsidies received? It makes no sense to tally subsides without tallying taxes; you can't list liabilities without listing assets. An industry that pays a dollar in taxes and receives 25 cents as a subsidy is different than an industry that pays a dollar in taxes and gets 50 cents as a subsidy.

In summary, my subsidy metric would be as follows:

% subsidization = ($subsidies - $taxes paid)/ $ production

Using this non-dimensional number, I'm confident nuclear power would prove superior to anything else on the list.

Energy Policy Project (third publication down). It goes beyond R&D and references how a value for Price Anderson as a subsidy could be derived. Although Price Anderson doesn't qualify as a direct subsidy, it nonetheless distorts the market, just as state targets and mandates for renewables do. The REPP report also notes that for the first 15 years, nuclear power received much in the way of subsidies while generating little power in return (suggesting there is a lag between investment and results). There are significant apparent differences between the studies and it would be interesting to more fully understand the differences in methodology.

PA was not a benefit to the Nuclear Power Industry. It was designed to protect rate payers from being stuck with the bill for an almost unforeseeable catastrophe, one that has not if fact occurred in the half century since the laws enactment.

In the era when all utilities generated the power they sold, and when their rates were based on their investment, a nuclear catastrophe would have left the rate payers without power and as the only stake holders left to pay for the damage.

Now that electricity is produced by merchant generators, PA is no longer necessary. Investors in the plants can protect themselves by contract and by separate incorporation. OTOH, the scheme seems to be quite sound and it could be continued.

>>Mag is actually Magnetohydrodynamics which is categorized as being a coal technology.

Isn't that tokamak fusion, not coal?

"Power reactor licensees are required by the act to obtain the maximum amount of insurance against nuclear related incidents which is available in the insurance market (as of 2005, $300 million per plant). "

I could almost conclude that the Price Anderson Act IS a subsidy, but not for the Nuclear Industry, for the Inusrance Industry!

John Wheeler

"This Week in

Nuclear" Podcast

One piece of information that is missing in your piece is a distribution between R&D for fusion research versus R&D for fission.

I think both are lumped together in the nuclear category, even though fusion is more about long term support for plasm physicists than it is about focused research on solving current and near future energy supply problems.

It should be no surprise to anyone who knows me that I think that fusion money should never come out of the Department of Energy. If supported at all, it should come from someplace like DARPA.

It definitely should not be counted as a subsidy for the nuclear power industry.

Rod

If you google Magnetohydrodynamics and coal you can find some info on how MHD uses coal for its application.

I reject the fundamental notion of the REPP study, which is that wind and solar power are new technologies worthy of subsidies to get them rolling. It's bunk. Windpower is centuries old, and the photovoltaic effect goes back to the nineteenth century. Neither one contributes much to our overall energy needs, and neither can come close to displacing the use of fossil fuels. Nuclear power, though still in its infancy, could eliminate the burning of coal or natural gas for electricity production.

The REPP numbers for the Price-Anderson act are sheer fantasy, except that Goldberg et al. refer to them as "indirect subsidies" to avoid the fact that the real cash flows have been practically nil. For Price-Andersen to be a subsidy to the nuclear power industry, you have to imagine regular, horrific accidents - the likes of which will never occur - and then imagine that the nuclear power industry cannot pay for the consequences, which is pure fiction, as well. But if you can make these two assumptions, well then yes, I guess PA is an indirect subsidy to the nuclear power industry.