With massive Asian economies needing ever larger supplies of energy, Australia is getting ready to export more uranium.

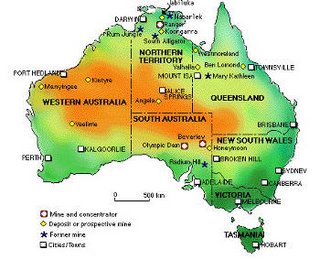

With massive Asian economies needing ever larger supplies of energy, Australia is getting ready to export more uranium.I know I've mentioned this issue before, but I think it bears repeating: I sleep well at night knowing that one of America's closest allies -- and one with rock solid political stability -- holds the world's largest reserves of uranium. The map on the left displays just how extensive the Australian uranium industry really is. It's good news for America and it's good news for the world.

As always, to keep up with the latest developments on the Aussie nuclear industry, check in with Robert Merkel.

Technorati tags: Nuclear Energy, Nuclear Power, Electricity, Environment, Energy, Politics, Technology, Economics, Uranium, Australia

Comments

There are two major issues slowing the development of uranium mining here: the first is a labour shortage in the mining industries at the moment (uranium's not the only commodity in huge demand right now). The second is the left-of-centre Australian Labor party (which is the minority party federally, but controls every single state and territory government) has a policy opposing the opening of new uranium mines. However, this will almost certainly change within the year; this policy will be discussed at the annual convention this year, there will be a lot of huffing and puffing but the general consensus is that the fix is in and the policy will be changed.

So when new plants get built, there will be uranium to fuel them, and with any luck you'll be buying a lot of it from us.