Chapter Two – Paying for Nuclear Energy

Chapter Two – Paying for Nuclear EnergyCaldicott, p. 19:

The nuclear industry myth says that nuclear power costs only 1.7 cents per kilowatt hour, whereas coal costs 2 cents and gas-fired power costs 5.7 cents.What I find irritating about this statement is that Dr. Caldicott didn't even source NEI for the numbers. These came from us, and if she’s going to dog us, we at least want the recognition. The numbers were the 2004 production costs found here (PDF, now includes 2005 figures, which the production costs of coal and gas have increased.)

On the same page, she cites a report from the New Economics Foundation that concluded “that the cost of nuclear power has been underestimated by almost a factor of three.” Here’s a previous blog done on the NEF report about a year ago.

Caldicott, p. 19:

Indeed, the nuclear industry baldly provides false estimates of the financial cost of nuclear electricity, failing to account for the total nuclear fuel cycle, basing their numbers on incomplete data.Come on. This tells me two things: 1) she didn’t take the time to explore our Web site, where she can find a link to costs here, or 2) she did find it but wanted to paint the picture of false estimates based on one chart.

Caldicott, p. 24:

If the economics of nuclear power look so dismal, why is there suddenly a huge push by the nuclear industry for new reactor construction?Maybe it’s that the figures are not as “dismal” as she believes. Markets are always changing, and have changed more and more in favor of nuclear power. Fossil fuels, particularly natural gas and oil, have experienced higher prices and increased volatility (PDF).

CO2 emissions are coming under more and more scrutiny by governments, and it is only a matter of time before CO2 regulations are in place in the United States.

In addition, the Energy Information Administration’s Annual Energy Outlook 2006, projects that the United States is going to need about 170 gigawatts of coal capacity by 2030. That’s equal to about 170 average-sized nuclear plants.

What these projections tell us is that the country is going to return to building baseload capacity. After about 15 to 20 years of building peaker plants (natural gas capacity), the United States will need baseload again by the middle of next decade. And what are the two options for baseload? Coal and nuclear. Perfect timing for nuclear.

Coal technology is becoming increasingly cleaner, especially with the latest technology -- the Integrated Gasification Combined Cycle coal plant. So far only a handful of IGCC plants have been built in the world, including two in the United States. According to a Wisconsin Public Service Commission draft report (PDF, p. 1):

As there is limited construction and operating experience with IGCC, there is a range of uncertainty in determining costs for IGCC.

Page 19 of the report details the projected capital costs for the technology. It’s about the same range of some estimates for new nuclear plants. And this is without CO2 sequestration.

I’m not trying to rail on the new coal technology because, in my opinion, it’s the advancement of technology that will reduce emissions eventually to nil. My point is to show that new coal and nuclear plants are in the same boat with regards to capital costs and uncertainty. And these are the two large-scale generating technologies that will be built over the next several decades.

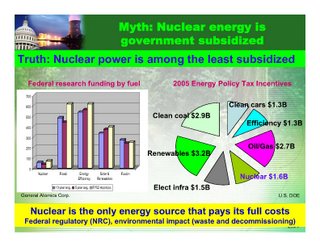

Back to Caldicott. Since we are discussing economics, you can imagine that subsidies soaked up quite a bit of ink in this chapter. Particularly regarding the latest energy bill. The only problem I have with this is that she does not show what incentives other energies received in the bill as well. Energy bills have not been passed without something for everyone.

According to slide 6 of an Entergy presentation (PDF), a pie chart shows the incentives received by all energy sources, as well as how much R&D funding has been received over the past decade. Nuclear was right smack in the middle of the pack for incentives received.

Economics is key to a sustained “nuclear renaissance.” The primary costs of concern are the construction costs due to the substantial amount of money needed to build a reactor. And of course, escalating costs are primarily what halted new-plant construction in the past.

Much has changed since then. Standardized designs, a one-step licensing process and simpler reactor technologies, to name a few factors, should make nukes much easier and faster to build. The key is getting over the uncertainties and hurdles of the first few new plants.

But it can be done and will be done, and we have confidence that the next generation of nuclear plants will be popping out on an assembly line over the next several decades.

Technorati tags: Nuclear Energy, Nuclear Power, Electricity, Environment, Energy, Politics, Technology, Economics, Helen Caldicott

Comments

If it's private companies putting up the money to build the things, and they are receiving less subsidy than other sources, if they're silly enough to waste their money why should the government intervene to stop them?

Not that I think that the prospective builders of new nuclear are silly, but the point being that it's their money to invest in a (somewhat) free market, and if anything the market is tilted against them because of the extra regulatory hurdles nuclear faces when compared to coal.

According to a poll by Bloomberg and the Los Angeles Times this summer, 61 per cent of respondents support the increased use of nuclear power as a source of energy in order to prevent global warming.

The tide of public opinion would seem to be turning. Hard to sell fear when no one is buying.

You have picked a 10-year window for your subsidy argument in which the nuclear industry has been dormant (in terms of adding new capacity) and all the other sources have been growing.

Nuclear Energy has recieved massive subsidies (nearly $50 billion) over the past 30 years. $4 to nukes for every $1 to renewables...according to a cummulative federal energy R&D funding graph [source IEA] (on pg 36 of a recent americanenergy.pdf found at www.americanenergynow.org)

Until you guys can at least be honest with yourselves, you will have trouble convincing others that this time is different...

Compare apples to apples. In the last 30 years, the nuclear power industry has produced hundreds of times more energy than the "renewables" (excluding hydropower) industry. When you normalize to a per unit output basis (kw-hr), renewables get far more in the way of subsidies. Even the Goldberg REPP study of 2000 - a favorite source for the anti-nukes - concedes this point.

In relation to the size of the industry and the taxes it pays, $50 billion over thiry years is minimal. You're making a fuss over 1.7 billion a year? How naive! Nuclear power pays back more than that just in property taxes (~ 10 -20 million per plant, per year) and user fees, never mind state and federal taxes.

Well I may be naive, but that is beside the point. Before I was just talking about the R&D subsidy (in response the blog-post).

Go back more than 30 years and the R&D subsidy number grows to $65-75B.

There is also the insurance subsidy ~$3B/yr (Price-Anderson). I'm sure that comes to $100B+ subsidy since it was enacted.

There is the subsidy in the lower tax rate on the decomissioning trust fund(s) of 20% vs. 30%+.

There are several new subsidies (since 05 energy bill) that I don't have the details in front of me at the moment. I know that a PTC, ITC, loan guarantee, more federal R&D and license application subsidy

were proposed.

There are other subsidies related to the uber-long term waste storage and decomissioning costs. (I know there is a fund but I am fairly sure that the fund will prove underfunded come decom time. Does this fund get a better tax rate too?)

I have to agree that you are naive or just reading talking points.

The Price Anderson "subsidy" is certainly a unique beast - a $100 Billion subsidy that has never cost the taxpayers, the plant owners or the public a single dollar. If all our "subsidies" were like that it would certainly help the federal spreadsheet.

The Production Tax Credit is a subsidy - exactly the same one extended to wind and solar - except that it doesn't last as long.

It's not clear that the licensing delay insurance for the first few new plants is really a subsidy. Owners will pay for the insurance.

Waste storage and decommissioning are paid for by the plants, not a subsidy. The waste fund may or may not be adequate. Technically it is more than adequate but the federal process seems to be wasting money from this fund at an alarming rate.

YOu may be fairly sure that decommissioning is underfunded but almost anyone who actually knows about decommissioning will disagree with you. A number of facilities have been decommissioned within expected budgets and, with life extension being approved for most plants, decommissioning seems to be significantly overfunded.

Your naïveté is quite clear, or as keng mentioned, perhaps you are just reading talking points with giving them any critical thought.

See, over 30 years ago the whole accounting for spending on "nuclear" becomes even more muddled up.

Nuclear weapons are expensive. But assuming your figures are given in today's dollars, that still is not a large sum of money, when compared to today's defense budget. Furthermore, this money went towards research (which unfortunately has to be grouped together like this) that provided the major weapon in the US's arsenal during the Cold War and now provides about 20% of the countries electrical generation.

Compare apples and apples. To claim that all of this money is a subsidy for the commercial generation of electricity is akin to claiming that the Army Air Corp's budget for research into producing better propeller-driven fighters and bombers should be counted as a subsidy for modern windmills and the Air Force's budget for developing advanced jet aircraft should be counted a subsidy for natural gas plants (which are essentially a jet engine connected to a gas turbine). In fact, I would argue that that latter two points have a stronger case, since a wind turbine has a lot more in common with a propeller on a WW II-era plane and a modern gas plant has a lot more in common with a jet engine than a commercial nuclear plant has in common with an atomic bomb.

So please, when you go throwing about old numbers, or estimates (guesses?) of old numbers, be sure to specify how much of these "subsidies" went specifically for commercial electricity generation and how much went to weapons development or other things. Otherwise, your numbers are meaningless.