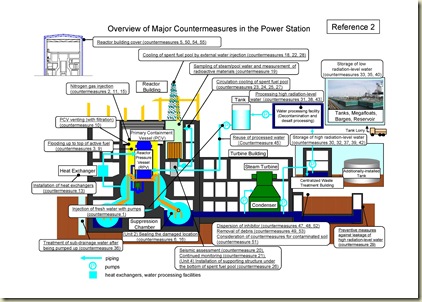

Yesterday, TEPCO released their plans on how to stabilize the plant in the short term. Below is a one-page overview of the plans (pdf).

Nuclear Street has a good description of some of the main objectives:

TEPCO said that after 3 months it expects radiation levels to decline at the plant, followed by cold shutdown in reactors 1 though 3 within six months. Also in that timeframe the company plans to cover units 1, 3 and 4 using a temporary “scaffolding” to minimize the escape of radioactive elements from damaged reactor buildings.

In the near-term, TEPCO will strengthen the walls and base of the spent fuel tank in unit 4. Unit 2 will continue to be drained of irradiated water believed to contribute to some of the highest dose readings at the plant. Eventually, the company will flood the containment vessels of units 1 through 3, with unit 2 requiring additional work to seal its containment vessel beforehand.

At TEPCO’s press release, you can find more links and descriptions of the plan. The link to Appendix 2 (three-page pdf) is the most detailed document and highlights the risks of the actions in red. As well, the countermeasures are numbered in Appendix 2 and are conveniently matched to the plant overview image above.

Comments